Junior/Small/Micro caps to outperform Large Cap Gold Stocks.

The market will now discount junior/small/micro caps based on reserves and timeframe to get those reserves - this is partly because if the large caps want to keep up with growth rates, they must start to buy juniors/small/micro cap miners. They have the cash, they just have to do the research and find out which stocks can give them the most octane for their buck.

IVN, CDE, SIL.

P/E (Ratio)

AGNICO EAGLE MINES [AEM] 71.53

ELDORADO GOLD CORP [EGO] 67.70

GOLDCORP INC [GG] 58.31

ROYAL GOLD INC [RGLD] 47.05

COMPANIA MIN BUEN [BVN] 47.00

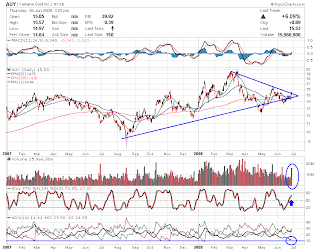

YAMANA GOLD INC [AUY] 44.42

KINROSS GOLD CP [KGC] 42.09

BARRICK GOLD CP [ABX] 22.16

GOLD FIELDS LTD ADS [GFI] 17.18

NORTHGATE MINERALS L [NXG]

DRDGOLD LIMITED ADS [DROOY] 2.98

APOLLO GOLD CORP CDA [AGT] 7.29

RICHMONT MINES [RIC] 10.69

NORTHGATE MINERALS L [NXG] 14.14

GOLD FIELDS LTD ADS [GFI] 17.18

COMPANIA MIN BUEN [BVN] 47.00

ROYAL GOLD INC [RGLD] 47.05

APOLLO GOLD CORP CDA [AGT] 7.29

RICHMONT MINES [RIC] 10.69

NORTHGATE MINERALS L [NXG] 14.14

GOLD FIELDS LTD ADS [GFI] 17.18

COMPANIA MIN BUEN [BVN] 47.00

ROYAL GOLD INC [RGLD] 47.05