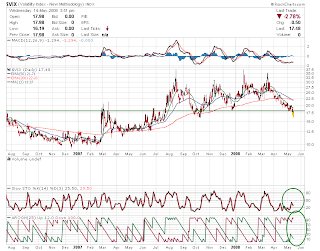

I'll start this off by asking which commodity forgot to partake in this global boom over the last several years? Zinc? Molybdenum? Rice? - nope, that one even roared. It's semiconductors, chips, and with the dismal action since the bubble bust of 2000, a baby bull may have just been born. The $sox chart may be signaling the beginning of a major semiconductor bull that could have us reaching for the old 2000 highs, and could last for several years to come.

There are many reasons that suggest that the tides are shifting, and why the semi's bull rise may be competitive to the type of returns the commodity landscape has delivered over the last couple of years. Sure, there are many fundamental reasons to stay away from semiconductors - inventories, pricing, competition, etc, - and anyone can blurt them out, but the charts may be telling us that we have seen the worst.

Semicondoctors are the commodity of technology and lead in technolgy cycles, but during this bull market of the "commmodities" - that started after the technology bust - semiconductors have been out of favor. Why? Now people want to build things - structures, airports, roads, buildings, planes, industrial plants, etc. - things that require earth moving type of forces. We have infrastructure buildout in every crevis of this tiny world of ours today and we need space for people to live, work, eat and sleep, and this is one of the main contributors to the commmodities rise - growth, demand, inflation, expanding universe, whatever you want to call it, it has been real and ferocious. Global growth has produced mass laborous movements that require many tons and tons of raw materials, and every commodity is in need, but nowhere has there been talk of the semicondoctor industy - the chips are, essentially, dead. Or are they?

Looking at the market from a technical standpoint, I want to first take notice that during this infrastructure buildout using commodites, the SOX index has gone from its lofty 1300 levels of the 'good ole technology days of 2000', to just shy of 400 as of today(350 just a month ago). During this time frame, the world has seen growth rates soar, markets roar, and not one second was it a bore, unless you were investing in the semiconductor industry and it's overbuilt, 0ver-marginalized issues.

Yes, that's the reality of the past, but markets discount forward. We can already see DRAM prices have already started to level and are begining to move higher.

That gets rid of the pricing issue. (And to note on pricing, I would say the US manufacturers have a global advantage because of the dollar- hence, QIMONDA). And if we look at the competitive landscape today, the pace of partnerships has increased, the talks of mergers and acquisitions have begun, and with some manufacturers on the verge of bankruptcy, this suggests the competion may start to consolidate.

Let's get back to that commodity boom that built skyscrapers higher and faster than ever before -DUBAI. You can span the globe to find cities emerging from the earth's crust. Now that the buildings and cities have been built and the middle class economy emerges, they are going to need technology. The middle class is going to buy hundreds of products in their lifetime that will have these out of favor chips in them. And if they don't already use a chip at least 50 times during the day, they soon will. We have built out the massive structures, but now we have to modernize the classes, and that requires lots and lots of chips, lots and lots of technological gadgets to advance our daily habits. The city has been built - let the countryside migrate and let them have chips! The next commodity has been found.

Semi plays -

Micron(MU) Advanced Micro Devices (AMD) Sandisk (SNDK) ASM International (ASMI) Kulicke and Soffa Industries (KLIC)