.png)

CHESAPEAKE ENERGY CP(NYSE: CHK)

&

FREEPORT MCMORAN B(NYSE: FCX)

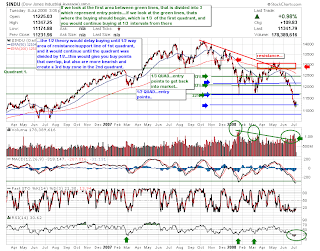

Above is a chart of CHK at the beginning of the 08 and after an almost 2 year consolidation. If we look we can see that the "headfake" or sometimes known as"search and destroy" techniques, took affect on CHK before it's rocketing breakout move.

The first chart shows what it looked like and the 2nd chart shows where CHK went after the headfake and breakout.

I am looking at FCX in the same respect here, as of today. Sure, we could break down and I would put a sell-stop at 98.50 for that, but we could also be seeing the same thing that happened to CHK in the beginning of the year happen with FCX.

CHK made a move back to the 200 EMA at tested the main trendline and as you can see by the 2nd chart, and FCX is doing nearly the same thing. This also means the degree of the trend angle could be shifting higher, meaning the trendline is steepening.