Technically Examining: UNG vs. Natural Gas

If we look at both charts we can first see that the commodity itself is volatile in nature. The UNG or Natural Gas itself shows an extreme amount of volatility vs. things like GLD, USO, SLV, etc.

The best way for individuals to connect their investments directly to the price of natural gas, or other commodities, is to buy the ETF - a byproduct of the price itself that has been created by leading investment banks. The UNG was recently IPO'd last year and this is where technical analysis becomes fragile due to the nonexistence, or minimal existence of a "history" from which a technical analyst would draw from. At the current moment, the technicals on UNG have been decimated and will be volatile near term, and in corrective mode for medium to long term (6m-1y). One thing for sure about UNG is that the volume has entered a new phase of open interest which means more and more are flocking to this investment tool.

If we now center our attention on Natural Gas prices themselves, we can see more of a "historic" presence that exists. The recent move of natural gas from 5.5ish in the middle of 07 to 13.5ish just a couple of weeks ago is a 120%+ return, which is not bad for a commodity in such a short time. This correction still puts Natural Gas prices with a respectable 40%+ return from its low of 07.

Fundamental Difference.

One thing to examine is why natural gas itself is not trading at all time highs vs. other commodites, oil in particular. Oil is widely more used than natural gas, and only recently in the last decade has natural gas been looked at as a highly viable alternative. This means that the infrastructure for Nat Gas is not as extensive as oils infrastructure and this has to do with oil's deep integration into our lives vs natural gas. You might think about using natural gas in your home, if its available, but not many would think about a natural gas car, motorcyle, or lawnmower, etc.. This is why the price itself is more volatile than oil, and other commodites. Oil is available in many more facets of our daily lives, but Natural Gas is still neither here nor there, but that is improving and should continue to stablize prices themselves - natural gas needs more infrastructure buildout so that when we make energy decisions, its available.

One conintinet that has a better natural gas infrastructure is Latin America, and most notably Brazils healthy appetite for natural gas as an alternative to oil. Due to the abundance of natural gas in the valleys and hills of Brazil, Argentina, Bolivia, etc., Latin America has diversified its energy habits to include natural gas and the infrastructure buildout is more advanced. There are many natural gas piplelines that exist and many that are in construction, with Bolivia being the most notable new entry into the natural gas pipeline game in Latin America.

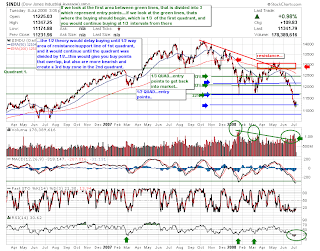

From the technical standpoint on UNG, one would want to evaluate their timeframe. The IPO gives it less history from which to draw from. You should look at Natural Gas resistance and support levels to coordinate buy and sell signals on the UNG. Natural Gas has had trouble with the 13-15 area - it has encountered turbulence entering a new price level. It could be becuase natural gas is a consumer adoption choice vs oil which is a consumer oriented need - we use more oil in our daily lives than natural gas. If we continue to see increased adoption and further penetration into oils consumer market share, then prices should break above that ever elusive 13-15 area. Until then, expect more volatility.

UNG

1m-3m: prices could see 50 but that is also resistance.

3m-6m: prices could see the a breaking of the 50 mark and enter new trading range.

1y+: prices could see natural gas moving towards highs.

.png)