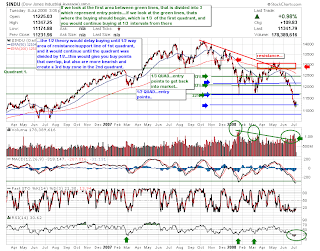

Market bounce is more probable as the VIX and DJIA will show - not too mention we have oil prices falling.

This is the first resistance for VIX. We could fall off resistance and market bounces aggressively, or we still penetrate through to the dotted blue line. Either way we are entering convergence of DJIA and VIX - look at the 1/2 Quad Strategy and the VIX resistance.