ISHARE MSCI JAPAN IN(NYSEArca: EWJ) - BUY

TimeFrame - Long Term(1-3yrs)

Low Risk and Low Beta

1st Target: < 6months - $13.50

2nd Target: 6 -15 months - $15

2nd Target: 6 -15 months - $15

3rd Target: 1-3yrs - $19

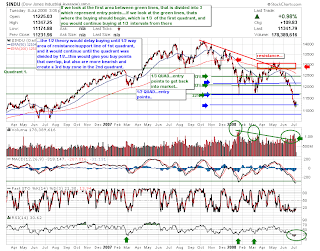

The EWJ is showing a recent consolidation pattern that may be nearing an end. There are 2 charts: a daily and a weekly. The weekly trendline is being tested in the first chart. The 2nd chart shows a shorter time frame which suggests more volatility ahead but with MACD's testing the low again, the RED AROON extended on the corrective side of things, and the recent stochastic jump, we are seeing positive technical developments that suggests that EWJ is continuing to carve out a bottom. We do need to see volume confirm this, so watch for this in the coming weeks.

Breakdown target would be 10.50.

.png)