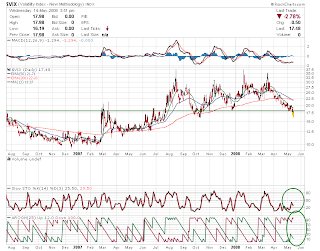

When picking stocks over the course of the next couple of weeks, and being the technical trader, one needs to look for patterns that have symmetry, similarities, smooth EMA's, etc. The Hang Seng chart above shows a very symmetrical correction, but before we look at chart technicals, let's first look at the common threads of the global hiccup from a correlated numbers perspective.

Knowing that the market discounts 6-9months ahead, the 18 month timeframe - which will be this august - would give a nice symmetrical number in addition to the nice symmetrical patter. Lets look at these numbers

-6 months (march07 - aug07) - timeframe from first selloff until US markets rolled over.

-12months (march 07 - march 08) - when US and Hang Seng bottomed

- 18months(march07 - aug08) - this August will be 18 months - which would be 2-3 different discounting periods for the market based on the premise that the market discounts 6-9 months out.

This August, the market will be discounting the 24m-30m timeframes from beginning of correction. I believe there will be an attempt at new territory which puts the market(DJIA, NASDAQ, S&P) moving towards old highs this winter - the 24m discounting period which will start in late August.

What's the importance of this? Well, Technical Analysis is looking at patterns, not only in charts, but in general. Is it coincidence that the numbers look like that(although the august test is yet to be determined) but this is how one should think when it comes to being more of a swing trader, than a long-term investor(although TA can pick some nice LT bottoms also).

Let's also not forget that China started all of this and their markets have corrected the most due to the rise of domestic inflation which has pounded their domestic economy and parts of their exports. This is all good because this is the pangea of economic integration and while the markets are down the most, they also have been consolidating for that 18months, which is numerically related to the lucky number 8 in Chinese philosophy. So, if we are in 2008 and its been 18months, and August is also the 8th month of the year, well then, I'm betting Asian markets, specifically the Hang Seng, will start to outperform world markets again, especially if we get oil pulling back, which seems more likely everyday.

****Look at QUAD strategies in playing the Dow Jones Industrial Average for the summer. Posted below.